What is Investment Management? And How It works?

Table of Content

- What is Investment Management

- Investment Management Objectives

- How Does Investment Management Work?

- Types of Investment Management

- Is Investment Management a Good Career for you?

- Conclusion:

What is Investment Management?

Investment management is also known as Venture administration a business discipline

Venture administration, moreover known as resource administration, is the proficient administration of different securities (such as stocks, bonds, and other resources) and other resources (like genuine domain) to meet indicated speculation objectives for the advantage of financial specialists. These financial specialists may be teachers (such as protection companies, benefits reserves, enterprises, charities, and instructive foundations) or private speculators, specifically through venture contracts or collective speculation plans (such as common stores or exchange-traded funds).

Key Components of Speculation Management

Resource Allocation:

– Deciding on a suitable blend of diverse resource classes (e.g., values, settled salary, genuine domain) to accomplish venture goals. Resource assignment is based on components such as the investor’s hazard resilience, speculation time skyline, and money-related goals.

Security Selection:

– Choosing person securities inside each resource course. This includes analyzing the basics of diverse securities, such as their budgetary well-being, showcase position, and development potential.

Portfolio Strategy:

– Creating a methodology for how the portfolio will be overseen. This can incorporate choices on dynamic versus detached administration, the utilization of subsidiaries for support, and other strategic decisions.

Chance Management:

– Recognizing, analyzing, and moderating the dangers related to diverse speculations. This incorporates showcase hazard, credit chance, liquidity hazard, and operational risk.

Execution Measurement:

– Frequently evaluating the execution of the venture portfolio against benchmarks and speculation objectives. This includes analyzing returns and considering alterations to the procedure as needed.

Client Administration and Communication:

– Routinely communicating with clients to overhaul their portfolio execution, get any changes in their budgetary objectives or change resistance, and give direction and advice.

Sorts of Venture Administration Services

Optional Speculation Management:

– The speculation chief makes all venture choices for the sake of the client, based on agreed-upon objectives and guidelines.

Admonitory Speculation Management:

– The venture chief gives counsel and proposals, but the client makes the last speculation decisions.

Robo-Advisors:

– Mechanized stages that give algorithm-driven monetary arranging administrations with small to no human supervision. An ordinary robo-advisor collects data from clients about their monetary circumstances and future objectives through an online study, and at that point, it employs the information to offer exhortation and/or naturally contribute to client assets.

Objectives of Speculation Management

– Capital Development: Expanding the esteem of the speculation portfolio over time.

– Pay Era: Giving an unfaltering stream of pay through profits, intrigued, or other income-generating investments.

– Conservation of Capital: Ensuring the central sum contributed from loss.

– Assess Proficiency: Overseeing ventures in a way that minimizes charge liabilities.

Investment administration requires a profound understanding of monetary markets, venture rebellious, and financial patterns, as well as the capacity to analyze complex information and make educated choices. The extreme point is to meet the particular money-related objectives of the speculator overseeing chance and guaranteeing that the portfolio is adjusted with the investor’s needs and inclinations.

Investment Management Objectives

Speculation administration targets are the particular objectives that financial specialists aim to accomplish through the administration of their venture portfolios. These destinations direct the techniques and choices made by venture supervisors and are custom-fitted to meet the needs and inclinations of person or regulation financial specialists. Here are the essential venture administration objectives:

Capital Growth

– Objective: Increment the esteem of the venture portfolio over time.

– Approach: Center on ventures with tall potential for appreciation, such as development stocks, genuine bequest, or wander capital.

Wage Generation

– Objective: Create a consistent stream of salary from investments.

– Approach: Contribute to income-producing resources like dividend-paying stocks, bonds, and genuine domain venture trusts (REITs).

Conservation of Capital

– Objective: Secure the foremost sum contributed from loss.

– Approach: Add to okay protections, for example, government securities, top-notch corporate securities, and money feature instruments.

Liquidity

– Objective: Assurance that adventures can be easily different over into cash without significant hardship of significant worth.

– Approach: Keep up a parcel of the portfolio in exceedingly fluid resources like cash, cash advertises reserves or short-term bonds.

Charge Efficiency

– Objective: Minimize assessed liabilities and maximize after-tax returns.

– Approach: Utilize tax-advantaged accounts, tax-efficient venture vehicles, and methodologies such as tax-loss harvesting.

Diversification

– Objective: Spread hazard over different resource classes and securities to decrease the effect of any single investment’s destitute performance.

– Approach: Make an adjusted portfolio with a blend of stocks, bonds, genuine domain, and other resource classes.

Hazard Management

– Objective: Distinguish, analyze, and relieve dangers related to investments.

– Approach: Utilize supporting methodologies, resource allotment, and broadening to oversee and control chance exposure.

Assembly Particular Budgetary Goals

– Objective: Adjust the speculation procedure with particular money-related objectives such as retirement, instruction financing, or acquiring a home.

– Approach: Create a custom-made venture arrangement that considers the time skyline, chance resistance, and money-related goals of the investor.

Moral and Social Considerations

– Objective: Contribute in a way steady with the investor’s moral convictions and social values.

– Approach: Center on socially mindful contributing (SRI) or natural, social, and administration (ESG) criteria when selecting investments.

Beating Inflation

– Objective: Guarantee that the speculation returns outpace swelling to keep up or increment obtaining power.

– Approach: Contribute to resources with potential for higher returns, such as values, or genuine resources like genuine bequests and commodities.

Execution Benchmarking

– Objective: Degree and compare speculation execution against particular benchmarks or indices.

– Approach: Utilize benchmarks like the S&P 500 for values or the Bloomberg Barclays Total Bond File for settled wages to assess the portfolio’s performance.

Each of these targets requires a distinctive approach and procedure, frequently including a combination of speculation sorts and strategies to accomplish an adjusted and well-performing portfolio. The particular destinations chosen will depend on the investor’s personal circumstances, inclinations, and budgetary objectives.

How Does Investment Management Work?

Venture administration includes an organized handle where proficient supervisors supervise and make choices around an investor’s portfolio to accomplish particular monetary objectives. Here’s a step-by-step layout of how speculation administration regularly works:

Understanding Client Objectives and Chance Tolerance

– Introductory Interview: The preparation starts with a meeting where the speculation director accumulates nitty gritty data about the client’s budgetary circumstances, objectives, time skyline, and chance tolerance.

– Objective Setting: Based on this data, clear venture destinations are set. These can incorporate objectives like retirement reserve funds, instruction financing, or capital growth.

Creating a Speculation Strategy

– Resource Allotment: The director devises a resource allotment methodology, choosing the extent of the portfolio to be contributed in different resource classes (e.g., stocks, bonds, genuine domain) based on the client’s objectives and chance tolerance.

– Speculation Determination: Particular speculations inside each resource lesson are chosen. This includes selecting personal stocks, bonds, common stores, ETFs, or other securities.

Portfolio Construction

– Building the Portfolio: The chosen ventures are combined to make a broadened portfolio. Broadening makes a difference in spreading chance and decreasing the effect of any single investment’s destitute performance.

– Execution: The chief executes the speculation technique by buying the chosen securities.

Nonstop Observing and Management

– Execution Following: The portfolio’s execution is routinely checked and compared against benchmarks and the client’s goals.

– Alterations and Rebalancing: Based on execution surveys and changing showcase conditions, the portfolio may be rebalanced. Rebalancing includes altering the weights of diverse resource classes to keep up the craved allocation.

Chance Management

– Recognizing Dangers: Potential dangers that might affect the portfolio are recognized and assessed.

– Relieving Dangers: Procedures such as expansion, support, and the utilization of subsidiaries may be utilized to moderate risks.

Normal Detailing and Communication

– Client Reports: Normal reports are given to clients, specifying the execution of their ventures, any changes made to the portfolio, and the current assignment of assets.

– Interviews: Progressing meetings and gatherings with clients guarantee that the venture procedure remains adjusted with their objectives and any changes in their monetary circumstances or objectives.

Charge Management

– Charge Productivity: Speculation choices are made with assessment contemplations in intellect to minimize charge liabilities. This incorporates techniques like tax-loss collecting and utilizing tax-advantaged accounts.

Adjusting to Changes

– Showcase Conditions: The venture methodology may be balanced in reaction to changing advertising conditions, financial patterns, and modern speculation opportunities.

– Life Changes: Alterations are moreover made if there are critical changes in the client’s life, such as an alteration in wage, retirement, or a major expense.

Moral and Social Considerations

– ESG Components: If the client has particular moral or social inclinations, the director may consolidate Natural, Social, and Administration (ESG) criteria into the speculation determination process.

Audit and Feedback

– Yearly Surveys: Comprehensive yearly surveys guarantee that the venture procedure remains successful and adjusted with the client’s long-term goals.

– Client Criticism: Ceaseless criticism from clients makes a difference to refine and alter the speculation approach.

Investment administration is an energetic preparation that requires a mix of monetary ability, showcase information, and client understanding to viably develop and secure riches over time. By taking an organized approach, speculation supervisors point to meet or surpass the monetary destinations of their clients while overseeing hazards.

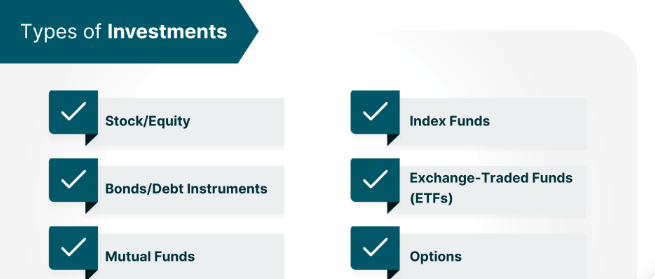

Types of Investment Management

Venture administration can be categorized into a few sorts based on the administrations given, the venture approach, and the level of client inclusion. Here are the essential sorts of speculation management:

Optional Venture The board

– Definition: The venture director has full specialists to make venture choices for the sake of the client without requiring to counsel them each time.

– Highlights: The supervisor chooses, buys, and offers securities agreeing to the concurred speculation procedure and goals.

– Benefits: Spares the client time and exertion, as the proficient director handles all venture decisions.

Warning Venture The executives

– Definition: The speculation chief gives counsel and proposals, but the last decision-making specialist remains with the client.

– Highlights: Clients get master direction but hold control over their speculation decisions.

– Benefits: Permits clients to be effectively included in their venture choices while still profiting from proficient advice.

Detached Venture The board

– Definition: This approach points to reproducing the execution of a particular showcase record, such as the S&P 500.

– Highlights: Includes contributing in list stores or ETFs that mirror the composition of the target index.

– Benefits: Regularly has lower expenses and costs due to less visit exchanging and negligible dynamic management.

Dynamic Venture The executives

– Definition: Directors effectively make choices to purchase and offer securities to outflank the showcase or a particular benchmark.

– Highlights: Includes thorough inquiries about, advertising investigation, and visit trading.

– Benefits: Potential for higher returns compared to detached administration, even though frequently with higher expenses and risk.

ROBO ADVISOR

– Definition: Mechanized stages that utilize calculations to give money-related arranging administrations with negligible human intervention.

– Highlights: Collect data from clients almost their money-related circumstance and objectives through online overviews, and at that point consequently oversee their investments.

– Benefits: Financially savvy, accessible, and accommodating for theorists, especially those with more modest portfolios.

Abundance The executives

– Definition: A comprehensive benefit that combines venture administration with other monetary administrations like domain arranging, assesses administrations, and monetary advice.

– Highlights: Centers on the all-encompassing budgetary needs of high-net-worth individuals.

– Benefits: Gives a personalized and coordinated approach to overseeing an individual’s whole budgetary life.

INSTITUTIONAL Speculation The board

– Definition: Venture administration administrations gave to expansive organizations such as annuity stores, protection companies, blessings, and foundations.

– Highlights: Ordinarily includes overseeing expansive entireties of cash and requires advanced procedures and change management.

– Benefits: Centers on accomplishing the budgetary objectives of teaching while following administrative prerequisites and guardian responsibilities.

HEDGE FUND MANAGEMENT

– Definition: Effectively overseen reserves that utilize different techniques to accomplish tall returns, regularly counting use, subordinates, and short-selling.

– Highlights: Pointed at well-off people and regulation financial specialists. Procedures can be complex and include higher risk.

– Benefits: Potential for critical returns, frequently uncorrelated with conventional advertise indices.

Secret Worth The board

– Definition: Includes contributing to private companies or taking open companies private, to move forward their esteem and offer them at a profit.

– Highlights: Long-term ventures ordinarily including dynamic interest in the administration of the companies.

– Benefits: Potential for tall returns through critical esteem creation in the contributed companies.

SOCIALLY RESPONSIBLE AND ESG INVESTMENT

– Definition: Venture methodologies that consider natural, social, and administration (ESG) variables near money-related returns.

– Highlights: Center on companies with maintainable and moral practices.

Benefits: Changes adventures with the financial backer’s qualities and can perceive organizations that are strategically set up for long-haul achievement.

Land Venture The executives

– Definition: Overseeing speculations in genuine domain properties or genuine estate-related securities.

– Highlights: Incorporates coordinate possession of properties, REITs, or genuine domain common funds.

-Benefits: Gives broadening, the potential for pay through rents, and appreciation in property values.

These different sorts of venture administration administrations cater to distinctive financial specialist needs, inclinations, and budgetary objectives. The choice of administration sort depends on variables such as the investor’s level of inclusion, hazard resistance, speculation skyline, and particular budgetary goals.

What Does an Investment Manager do?

A speculation chief, moreover known as a portfolio supervisor or resource director, is mindful of overseeing a client’s venture portfolio to assemble particular budgetary goals. Their part includes an extent of exercises, from selecting ventures to checking execution and overseeing chance. Here are the key obligations and assignments of a speculation manager:

Client Meeting and Objective Setting

– Understanding Client Needs Assembly with clients to talk about their budgetary objectives, chance resistance, time skyline, and speculation preferences.

– Setting Destination: Building up clear, achievable venture targets based on the client’s needs and circumstances.

Creating a Speculation Strategy

– Resource Allotment: Deciding the ideal blend of resource classes (stocks, bonds, genuine domain, etc.) to accomplish the client’s objectives while overseeing risk.

– Speculation Choice: Choosing particular securities or venture items inside each resource lesson. This might include selecting personal stocks, bonds, common stores, ETFs, or elective investments.

Portfolio Construction

– Building the Portfolio: Developing a differentiated portfolio that adjusts with the agreed-upon strategy.

– Introductory Speculations: Executing exchanges to set up the portfolio agreeing to the strategy.

Continuous Portfolio Management

– Checking Execution: Persistently following the execution of the portfolio against benchmarks and goals.

– Rebalancing: Intermittently altering the portfolio to keep up the wanted resource assignment. This might include buying or offering securities to adjust to the strategy.

Chance Management

– Distinguishing Dangers: Evaluating different sorts of dangers, such as showcase chance, credit chance, liquidity hazard, and intrigued rate risk.

– Moderating Dangers: Executing techniques to oversee and moderate these dangers, such as broadening, supporting, and resource assignment adjustments.

Inquire about and analyze

– Showcase Examination: Keeping up-to-date with showcase patterns, financial conditions, and geopolitical occasions that might affect venture performance.

– Security Investigation: Conduct principal and specialized investigation to assess the potential and execution of personal investments.

Execution Reporting

– Customary Reports: Giving clients point-by-point reports on portfolio execution, counting picks up, misfortunes, and changes in resource allocation.

– Survey Gatherings: Routinely assemble with clients to survey execution, talk about any changes in their monetary circumstances or objectives, and make essential alterations to the strategy.

Charge Efficiency

– Assess Arranging: Making venture choices that consider the assess suggestions to minimize assess liabilities and maximize after-tax returns.

– Tax-Loss Collecting: Offering securities at a misfortune to counterbalanced capital picks up and diminishes assessable income.

Client Communication

– Progressing Communication: Keeping up normal communication with clients to overhaul them on portfolio changes, advertising conditions, and any other important information.

– Client Instruction: Teaching clients almost speculation procedures, showcase conditions, and budgetary arranging to offer assistance to them to make educated decisions.

Compliance and Reporting

– Administrative Compliance: Guaranteeing that all speculation exercises comply with important laws and regulations.

– Record-Keeping: Keeping precise records of all exchanges and communications with clients.

Moral and Social Considerations

– ESG Contributing: Consolidating natural, social, and administration (ESG) criteria into the speculation prepare if it adjusts with the client’s values and preferences.

Adjustment to Showcase Changes

– Adaptability: Adjusting venture procedures to changing showcase conditions, modern financial information, and advancing client needs.

– Development: Remaining educated almost unused money-related items and speculation openings to upgrade portfolio performance.

By performing these assignments, venture directors aim to accomplish the monetary destinations of their clients, whether they are people, families, or educators. The objective is to develop and secure riches over time through cautious arranging, educated decision-making, and continuous administration.

Is Investment Management a Good Career for you?

Venture administration can be a great career for you if you have a solid intrigued in back and markets, have expository and communication abilities, and can handle stretch and long hours. It offers the potential for monetary rewards, career development, and the fulfillment of making a difference in clients accomplish their budgetary objectives. Be that as it may, it requires ceaseless learning and adherence to moral guidelines. Consider your individual and proficient desires, work environment inclinations, and capacity to oversee the requests of the work.

Conclusion:

In conclusion, Investment management is an energetic and multifaceted calling that includes overseeing client portfolios to accomplish particular monetary destinations. It includes an assortment of administrations, counting optional administration, admonitory administration, inactive and dynamic techniques, and the utilization of robo-advisors.

Key exercises of venture supervisors incorporate understanding client objectives, creating and executing speculation techniques, observing and rebalancing portfolios, overseeing dangers, conducting investigations, and guaranteeing charge productivity. Victory in this field requires solid expository aptitudes, consideration of detail, viable communication, and the capacity to make educated decisions.

The career offers noteworthy rewards, such as a monetary stipend, career development openings, and the fulfillment of making a difference in clients meeting their monetary objectives. In any case, it too requests a commitment to nonstop learning, the capacity to handle push, and adherence to moral standards.

Whether venture administration is a great career choice depends on your enthusiasm for back, your aptitudes and qualities, your long-term career objectives, and your capacity to flourish in a demanding and advancing environment. If these adjust with your yearnings and capabilities, venture administration can be an exceedingly satisfying and profitable career.